Help kids dream big this summer!

Students who come to St. Vincent de Paul's Family Dining Room and Dream Center have big dreams for their futures, but many face serious obstacles in achieving those dreams. You can help make sure students have nutritious food and educational enrichment this summer by supporting St. Vincent de Paul's Dream Big Campaign!

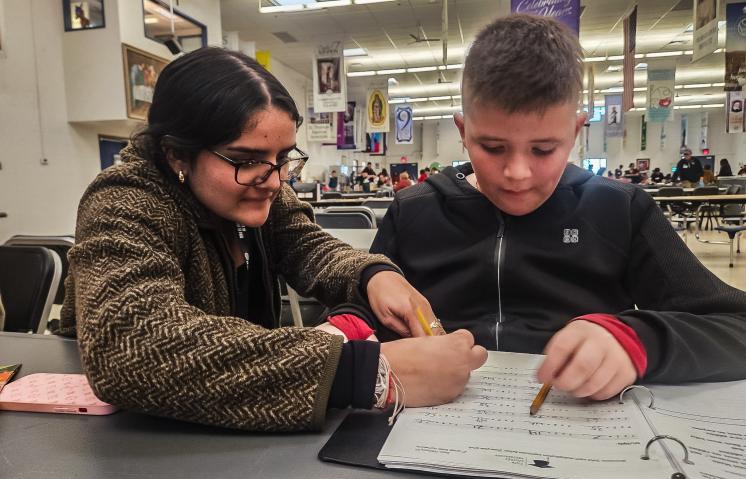

With your generosity, the Dream Center provides tutoring, educational play, and support for low-income students each weekday evening helping students stay engaged and prepare for their next grade level. And the Family Dining Room provides hot meals as well as friendship and community for families in need.

Give by April 30 and your gift will be matched up to $50,000!!

Host a drive

Whether at your school, church or workplace, you can host a drive to help us collect food, clothing and essential items. We make it easy! Simply fill out the interest form and we'll coordinate dates to drop off donation bins and pick up when you are done.

Featured Articles

Stories of hope made possible by generous gifts

Once a guest, now a volunteer

Denise and her kids were able to Dream Big thanks to SVdP's Family Dining Room

Mothers, daughters make first-ever 'Driveway Drive' a success

15 driveways participated and gathered 592 pounds of food and more

'One little lift' helped Christina Boston on her path to principal

20 years before leading Sheely Farms Elementary, she needed help paying a utility bill